The importance of saving

The most fundamental thing you need to know is - save early and save more. No one can control interest rates or accurately predict what will happen in the stock market. The two things you can control are when you start and how much you save.

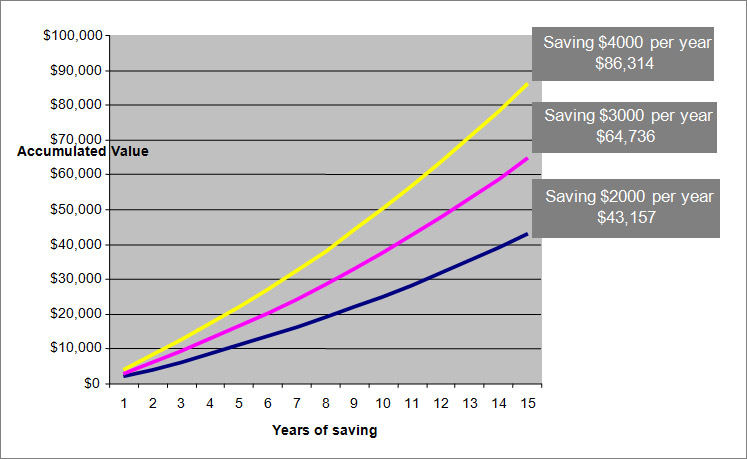

The value of saving early and saving more

The accumulations shown above assume an earnings rate of 5%.

Starting to save early puts time on your side. Your savings will add up and the longer your funds are working, the longer the power of compound interest will work in your favor.

Establish consistent saving habits

One of the easiest ways to establish a savings habit is to participate in your employer's 401(k) plan. Funds are withheld from each paycheck and deposited into your account. Many employers "match" part of your contribution, so you accumulate even more.

A second way to consistently save is with an automatic savings transfer program with your financial institution. You decide how much and when you want funds transferred from your checking account into a savings account. You can also use a payroll deduction plan from your employer and get the same results.

Saving smart

Along with how much and how often you save, what you earn on your funds will determine how fast your money grows. You can't control what happens with interest rates or the stock market, but you can consider different types of savings vehicles that provide different returns:

- Basic savings accounts are your safest choice when they are held in an FDIC or NCUA insured financial institution. You can access your funds quickly when you need them, but they generally offer the lowest rate of return.

- Certificates of Deposits (CDs) are also a safe choice and their interest rates are higher than a regular savings account. On the down side, they are also "time deposits", meaning there are penalties for early withdrawal. If you want guaranteed safety and can accept not having immediate access to your funds, CDs can be a good option.

- Investment accounts may offer higher earnings, but also greater risks of loss. Be sure to consult an unbiased financial advisor before starting a savings plan involving investment risk

We can help

If you have additional questions about how you can maximize your savings potential, visit one of our branches or call us at 1-800-288-3425.