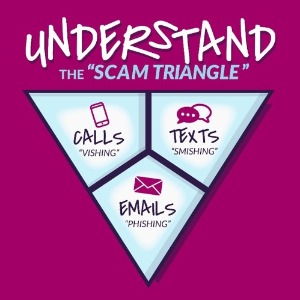

Understand the Scam Triangle

Keep your finances safe by avoiding phishing, vishing and smishing attempts. Use these tips to identify scams, protect your personal data (and bank account!) and outsmart fraudsters.

Phishing—don't take the bait.

Phishing scams try to lure you into giving up personal details through emails or fake websites that look legitimate. Be suspicious of phishing red flags like high-pressure language and incorrect grammar. Do not click on links or download attachments in suspicious emails.

Vishing—hang up on the phonies.

Vishing is like phishing, but with a voice twist. Vishing scams involve phone calls (often automated and maybe even using AI) that try to trick you into revealing personal information. Sometimes the scammer will even “spoof” a phone number so it looks legitimate. Never share any personal details over the phone with someone who calls you out of the blue.

Smishing—spot suspicious texts.

Smishing combines SMS (text messaging) with phishing. Smishing scams involve sending text messages that appear to be from a legitimate source, like your bank or credit card company, often urging you to click on a link or call a number to confirm some information or resolve a fictitious issue. Never click on links or call numbers from suspicious text messages.

Remember, if something seems too good to be true, it probably is! If you are ever unsure about the legitimacy of a communication purporting to be from Think Bank or another reputable company, contact us or the company directly through a trusted phone number or website (not the ones provided in the suspicious communication).