Online, email, & mobile security

For most users, their home computer holds personally identifiable information. Therefore, it is important that your computer be secured. To help protect your computer and your personal information, consider the following tips:

- Protect your answers to security questions - by not selecting questions easily determined through internet searches or social media sites. We will never ask you to provide answers to your security questions via Email.

- Use secure websites for transactions and shopping, using merchants you trust. Transactions should take place on secure connections identified by the lock symbol in the lower right-hand corner of your web browser window, or "https://…" in the address bar of the website. The "s" indicates "secured" and means the web page uses encryption.

- Public computers or internet connections (computers at internet cafes, copy centers, hotels, etc.) should be used with caution.

- Always log off from Think Online and any website after using your credit or debit card, or other sensitive information. If you cannot log off, quit your browser to prevent any potential unauthorized access to your account information. Be sure you have an up-to-date firewall and anti-virus program installed on your on your computer. Be sure to keep your web browser and computer operating system current and up to date. Before downloading an update to your computer program, first go to the company's website to confirm the update is legitimate. Install, run, and keep anti-virus and other software updated.

- Avoid downloading programs or attachments from unknown sources. Be careful with programs ending in exe, .com, .scr, .bat or .pif. Sometimes "free" programs likes screensavers contain malicious viruses, malware, or adware.

- Be aware of your surroundings when you are logging on to your computer, are at the ATM, or doing anything else where you are entering a password or viewing personally identifiable information. Make sure that no one else can view this information by shoulder surfing.

- If you believe your computer has been taken over by an outside source, disconnect it from the Web. Then, contact a computer professional for help.

- Password and PIN Protection. Your first line of defense on the Web is creating the strongest password possible to protect your computer, your data and your online accounts. When creating and managing your passwords, there are a number of dos and don'ts. Click here for a listing of some Do's and Don'ts.

Email security

Email is an important and easy to use form of communication. However, just as with any communication form, it can be used to trick you out of important information and it is important to be aware of the potential risks associated with email.

The most common form of attempted fraud using email is phishing. Phishing refers to suspicious emails you may receive at your home and/or work emails addresses. Many times the email appears to be from a legitimate company where you may have an account. The email will typically state that "the company is updating their records and they need you to verify some account information."

Emails direct the recipient to a website that looks like the actual site and then asks the recipient to divulge card account numbers and PINs, Social Security Numbers, and other personal information. The fraudsters have no idea where you actually have an account, they are simply targeting companies where many individuals have accounts.

If you think you have received a phishing email related to Think Bank, please forward it to think@thinkbank.com.

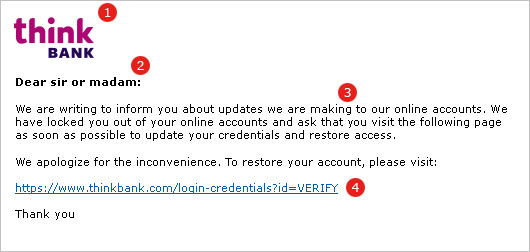

Anatomy of a fraudulent email

Keeping the following points in mind will help you determine if you've received a fraudulent email:

- Look for graphics that seem odd, misshapen, or incorrect. This is a sign that fraudsters took our graphics to make their email seem more realistic.

- Look for introductions that may seem strange or atypical from what you would expect from us.

- Many fraudulent emails claim there are serious issues that you need to address right away, when in reality there is nothing wrong. If in doubt, give us a call at 1-800-288-3425.

- Links to sites will often appear legitimate until you click on them and find that it has taken you to a different address that could potentially expose you to viruses. On top of that, the page may request that you enter information in an effort to steal your sensitive data and gain access to your accounts.

Mobile banking security

- You can enhance the security of mobile devices such as cell phones by requiring a pin number, password, or drawn pattern to unlock the device. For added protection, you may also consider installing security applications.

- Delete text messages from any financial institution before loaning out, discarding, or selling your mobile device.

- If you have elected to receive text messages about your accounts from Think and lose your mobile device, contact us to remove the number from your account. While the text banking system allows you to receive information about your account, it does not allow you to transfer funds, pay bills, or display your account numbers as a security feature in case of loss.

- If you use your mobile device to access the mobile banking system and lose your phone, there is not information about your accounts stored on your phone. Your accounts can not be accessed with the device unless a person has your username and password.

- Do not include important information such as social security numbers or account numbers in text message. If you receive a text message asking you to update your account information or activate and account it could be an attempt to gather your personal information called smishing.

- Apps that help you monitor your finances using your phone are becoming very popular. Download mobile apps from reputable sources only to ensure the safety of your personal and account information. Keep the most recent version of the Think mobile apps installed on your phone. You can find apps for Think's iPhone and Android devices here.